- A common feature of both FMPs (Fixed Maturity Plans) and FDs (Fixed Deposits) is that investors know in advance how much return they will earn on maturity

- The difference here is that while the returns on FDs are assured, returns on FMPs are indicative

- FMPs are actually close-ended debt funds with fixed maturity offering an indicative yield. The keyword here is ‘indicative’

- That means, on maturity there is a possibility of actual returns deviating from indicative returns

- On the other hand, returns are guaranteed by an FD and investors are assured of receiving the same on maturity (assuming there is no default in payment of principal amount and interest)

Why do FMP yields vary?

- FMP yields do not normally vary by a significant margin

- For the same tenure, the yields on debt instruments (with comparable credit ratings) are usually in a range, which is why FMPs of similar tenure have comparable yields

- The difference in yields between two FMPs arises out of the risk taken on in the portfolio – a FMP having top rated instruments in its portfolio would deliver comparatively less than a FMP with lower rated papers

- Higher return means that the fund manager has been taking on more credit risk in the portfolio

Fixed Maturity Plans (FMP) are alternate ways to keep your savings so as to get better post tax returns than fixed deposits (FDs). These are debt funds which do not invest in equities and hence free from volatility risk linked to stock markets. These are available for different terms ranging from 1 month to 5 years with periodic liquidity.

courtsy

Where to invest ?

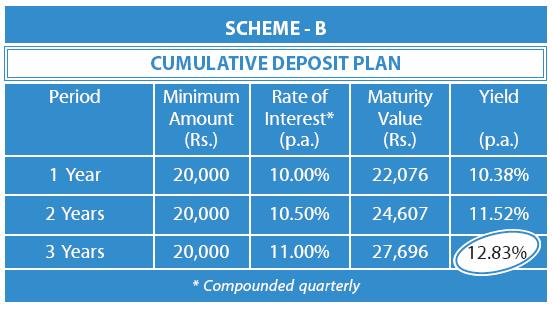

The answer to the question totally depends on you how much return you want? Where ever you get higher returns you would obviously invest you money there.